In Rwanda, one of the crimes that has greatly increased is fraud through technology, especially using mobile phones and social media. Many people have been scammed and lost money in unclear ways, and most of them were not able to recover their funds. In this story, we are going to explain the methods that fraudsters use to deceive people and how you can protect yourself from becoming a victim.

In previous years, when people were not yet aware of such fraud, they were often tricked through mobile money transfers. Someone would fabricate lies and make you believe them until you sent money. Many of you remember how fraud became very popular in Rwanda, with people receiving messages claiming they had received money, only for the fraudsters to later use that message to manipulate them. Let me explain how it used to work.

Before fraudsters tricked you this way, they first studied you. They would find out who you are, your full name, sometimes even your residence, and, most importantly, your phone number. This was to determine whether you were an easy target or not.

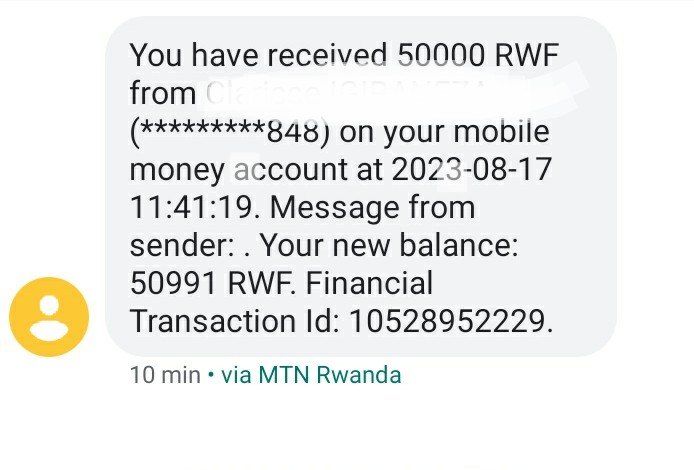

Once they had identified you, they would take a forwarded message — usually a genuine “money received” message they had gotten from their own transaction or copied from someone else’s phone — and edit the amount to suit their scam. They would then send you this fake message from their personal phone number. So, for example, you would receive something like: “You have received RWF 5000 from …” with the amount changed to what they wanted you to believe.

Normally, real mobile money receipts always show the sender as “MTN Mobile Money” or “AirtelMoney.” But on the fake messages, the sender would simply appear as an ordinary phone number. Because many people did not bother to check who the sender was, they would immediately assume that someone had mistakenly sent money to their account. This is exactly what the fraudsters wanted their victims to think.

After sending the message, the fraudster would quickly call you, greet you politely, and claim they had accidentally sent you money. They would then add an emotional twist, explaining that the money was urgently needed to solve a serious problem, like paying hospital bills for a critically ill patient. If you were the kind of person who reacted quickly without thinking carefully, you would likely send the money back, believing you were helping.

I remember when I first learned about this kind of fraud. It was my uncle’s wife who became a victim. She was at home when she received a text saying, “You have received RWF 45,000 from ….” She became excited, thinking someone had sent her money, but she did not check who the sender was. Her joy did not last long because, moments later, a man called her, claiming he had mistakenly sent her 45,000 RWF that he urgently needed to pay for hospital expenses. Out of sympathy, she agreed to help. The fraudster pressured her further, asking her to rush to the nearest MTN agent and send him the money. Without thinking twice, she did exactly as he instructed.

When she arrived at the agent, she called the fraudster again. He told her to send 40,000 RWF and keep 5,000 as a reward for her kindness. Feeling reassured, she instructed the agent to send the money to the number provided. The agent, believing she had cash in hand, processed the transaction. But when it came time for her to pay, she handed over her phone and told the agent to withdraw the money directly from her account. To everyone’s surprise, the system showed she only had 700 RWF. Shocked, she realized too late that the message she received had been fake.

A conflict then broke out between her and the MTN agent since the money had already been sent from the agent’s balance. She tried to explain, showing the message she had received, but others quickly pointed out that it was fake because the sender was just a normal number, not MTN Mobile Money. In the end, she and her husband had to reimburse the agent’s money to avoid legal consequences, since otherwise they themselves could have been accused of fraud.

There have been many other variations of this fraud. Sometimes the scammers would send a fake receipt and then call threatening that if you didn’t return the money, they would block your SIM card. Other times, they pretended to be MTN or Airtel staff, telling victims their SIM card was blocked and then asking them to dial certain numbers to “unlock” it — which actually transferred money out of their accounts.

To avoid being scammed in this way, you should always verify every message. When you receive a notification that you have received money, first check whether the sender is really “MTN Mobile Money” or “AirtelMoney.” Then, confirm by checking your account balance. If the money is not there, then the message is fake. Never share your PIN or any codes over the phone, even if the caller claims to be from MTN or Airtel. Ignore suspicious texts — if it looks too good to be true, like “You won money,” it is most likely a scam. Always use the official apps to check your transactions instead of relying on SMS. Stay calm under pressure, because fraudsters rely on rushing you into emotional decisions. Even if you do not lose money, report every attempt to the telecom company, as this helps authorities build cases against the fraudsters.

If the fraudster calls you, it is important to record the conversation. These recordings can later serve as evidence in court. Immediately afterward, contact MTN or Airtel and provide them with the scammer’s number so they can be tracked. If you accidentally send money to a fraudster, do not give up. Call the MTN or Airtel service center at once. If the fraudster has not yet withdrawn or transferred the money, it can be blocked and refunded.

Beyond that, you should also report to law enforcement, such as the Rwanda Investigation Bureau (RIB). With the evidence you provide — the fake message and recorded call — they can pursue the fraudsters, recover your money, and prevent others from being scammed in the same way. It is also your responsibility to share awareness with friends, family, and community members so they too can protect themselves.

Although we have explained this older method of mobile money fraud, it seems to have become outdated as fraudsters continue to invent new tricks. Therefore, it is important to remain vigilant and learn about new methods as they arise, so you don’t become their next victim.

Post Comment